Four reasons why joining the Advantages Retirement Plan™ as a medical student can help you lay the groundwork for a great retirement.

Medical school is an intense time in a young doctor’s life. While studies clearly take priority, you’re juggling other important things, too, such as sleep, exercise, fun, and managing your finances in support of it all.

It may seem like it’s too soon to think about saving for retirement in your twenties, but the reality is that building your savings for your retirement is one of life’s biggest expenses. Starting your savings early with the Advantages Retirement Plan™ can help you invest less each month, allowing your money more time to grow with compound interest.

As a member of the Ontario Medical Association, you have access to an easy and proven strategy for growing your retirement wealth in the Advantages Retirement Plan™- a first-of-its-kind award-winning plan. It’s similar to a workplace pension, and it’s exclusively available to Ontario’s doctors doctors and their spouses or common-law partners.:

Here are four reasons why joining the Advantages Retirement Plan™ as a medical student can help you lay the groundwork for a great retirement:

Based on your age and income, the plan has an easy-to-use online calculator to show you how much income you can expect in retirement, and how much to save. You can get started by contributing as little as $50 a month – the plan helps you automatically increase your contributions as your career grows and your income increases.

The plan automatically matches you to a diversified investment portfolio managed by BlackRock®, the world’s largest asset manager. When you save early in your career, your savings are invested in a higher mix of equities, such as stocks, to help generate a higher return. The plan is designed to rebalance automatically and become more conservative as you near retirement age.

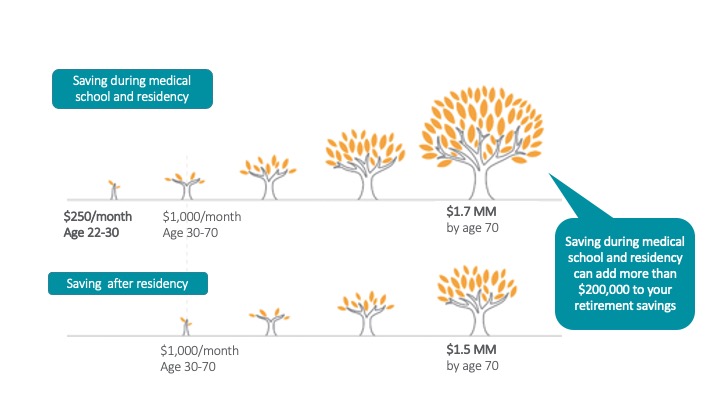

As a simplified example, say you decide to start your retirement savings plan after finishing residency. By saving $1,000 a month starting at age 30, you would have more than $1.5 million saved by age 70. But, as the chart illustrates, setting aside as little as $250 a month during medical school and residency would get you ahead, adding more than $200,000 to your total retirement savings*.

Every investment comes with fees, but members of the Advantages Retirement Plan™ pay only 0.6 per cent of their account value, plus a $10 monthly administrative fee. This is about one third of what most Canadians pay for their RRSP or TFSA and the difference gives your savings a powerful boost over time.

As part of the OMA Insurance Essentials offer, medical students who enroll in the plan and set up monthly contributions are exempt from the $10 monthly fee for four years from the time of enrollment. This puts some additional cash back into your account at a time when small savings can make a big difference.

To help you decide if the Advantages Retirement Plan™ is right for you, book a consultation with the OMA Insurance team of retirement specialists:

Guillermo Nafarrate

Ontario Central West

guillermo.nafarrate@oma.org