A unique approach to a Guaranteed Lifetime Income Annuity

A new offering that reduces risk to your retirement savings

As you approach retirement, you will likely want to start thinking about ways to use your savings to generate income that will last throughout all your retirement years. One way you can do this is through a life annuity — an insurance product that provides monthly income for as long as you are alive, regardless of what age you live to be.

About Guaranteed Lifetime Income Annuities (video)

What’s guaranteed lifetime income?

Most Canadians are living longer and the worry of outliving their retirement income is real and increasing. When surveyed, 82 per cent of OMA members said they needed help converting part of their retirement savings into regular, predictable income in retirement.

The Advantages Retirement Plan™ is now offering the option of purchasing a unique insurance-based savings solution that helps protect from the risk of outliving income. We call this the Guaranteed Lifetime Income Annuity.

The Guaranteed Lifetime Income Annuity is an insurance product underwritten by Blumont Annuity Company, a Canadian life insurance company licensed federally and in all Canadian provinces and territories.

The Guaranteed Lifetime Income Annuity guarantees to pay a monthly income benefit for life starting as early as age 60. You can determine what will help you meet your retirement income needs based on the following[1]:

- How much you want to buy

- When you want to buy

- How much income you want to receive

- When you want to start receiving your income

As the Guaranteed Lifetime Income Annuity is offered through the Advantages Retirement Plan™, it is bought with funds held in your registered plan[2] (with pre-tax dollars) and benefits are also paid into your registered plan. When money is withdrawn from your RRSP or RRIF, it is taxed.

Who is it for?

Uniquely designed for doctors

The Guaranteed Lifetime Income Annuity is designed for OMA members and their spouses/partners who would like to introduce some security in their retirement savings. This product complements the income you receive from the Canada Pension Plan and potentially Old Age Security benefits, as well as any other retirement savings.

Once you become a member of the Advantages Retirement Plan™ and turn age 50, you are able to join and purchase the Guaranteed Lifetime Income Annuity with your registered plan.

How does it work?

Putting doctors in control

Under the Advantages Retirement Plan™ you are responsible for investing in your account. Only you know how much income you need to retire the way you want to, but there are tools on the Advantages Retirement Plan™ portal to help.

The Advantages Retirement Plan™ online modeller helps you manage your choices within the Advantages Retirement Plan™. It can help you determine the right mix between TDF and the Guaranteed Lifetime Income Annuity investments in your RRSP. The modeller also estimates your Canada Pension Plan and Old Age Security benefits.

Within the Guaranteed Lifetime Income Annuity option, you choose:

- The age you want to start purchasing annuities

- The amount and timing of purchases (monthly, annually, lump-sum)

- When you want to start receiving retirement income

- How long you want your income protected against a premature death

Flexible contribution terms to fit any situation

With the Advantages Retirement Plan™, there are a few ways you can contribute.

These same options apply to your purchase of a Guaranteed Lifetime Income Annuity with the funds you have contributed to the Advantages Retirement Plan™:

- One or more lump-sum purchases

- Monthly purchases — the Guaranteed Lifetime Income Annuity allows you to purchase future income on a monthly basis

There are no hard and fast rules about how much of your Advantages Retirement Plan™ account you should allocate to purchase an annuity. It depends in part on the level of income security you want and the needs you will have in retirement. Working with the Advantages Retirement Plan™ retirement online modeller can help you determine what is the right balance between your TDF investments and Guaranteed Lifetime Income Annuity investment.

The modeller can illustrate for you how much income your Guarantee Lifetime Income Annuity purchases may generate once you start drawing payments. It takes into account multiple factors including your age, sex, the amount you buy, prevailing interest rates and the payment features of your Guaranteed Lifetime Income Annuity when you choose to start receiving income.

The plan in action

Enrolment in a Guaranteed Lifetime Income Annuity (video)

When you live longer, a Guaranteed Lifetime Income Annuity delivers exceptional value

Because of the features of the Guaranteed Lifetime Income Annuity, which is a form of life insurance, you are guaranteed to receive monthly income payments for as long as you live.

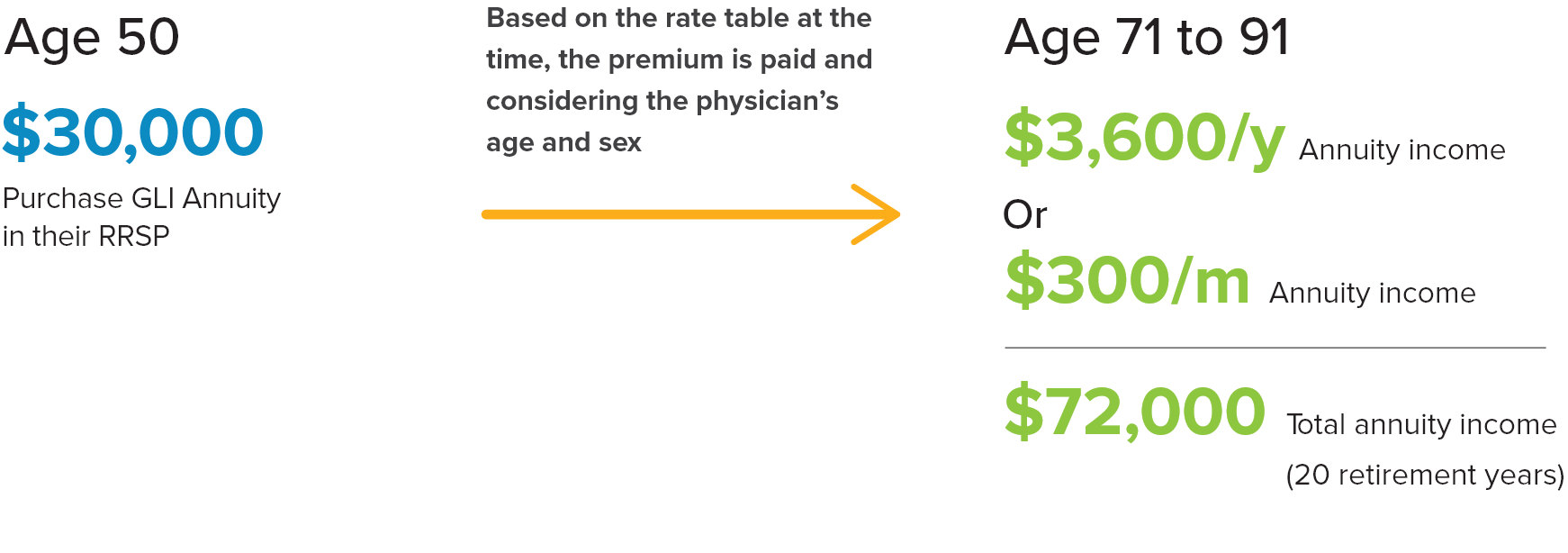

Scenario one

A physician is 50 years old and decides to allocate $30,000 of their RRSP account to purchase a Guaranteed Lifetime Income Annuity. Based on the rate table at the time, the premium is paid, and considering the physician’s age and sex, the $30,000 premium buys an annual annuity income of $3,600 or a monthly annuity income of $300 per month payable into their registered plan.

When the physician turns 71, a $300 per month payment commences and, thanks to their good health, they live another 20 years until they pass away at age 91. In total, the physician has received $72,000 in benefits paid into their registered plan for a contribution of only $30,000.

Protecting your contributions from premature death

The Guaranteed Lifetime Income Annuity offers different ways to protect your premiums should you pass away before you receive the full benefit of your contributions. The basic form Guaranteed Lifetime Income Annuity has a guarantee period of 10 years that starts from the date of your first monthly income payment. Should you pass away before the end of the guarantee period, your registered plan will receive a lump-sum payment for the balance of the unpaid guaranteed income. You have the option to choose a 15-year guarantee period rather than the 10-year guarantee if you want longer protection.

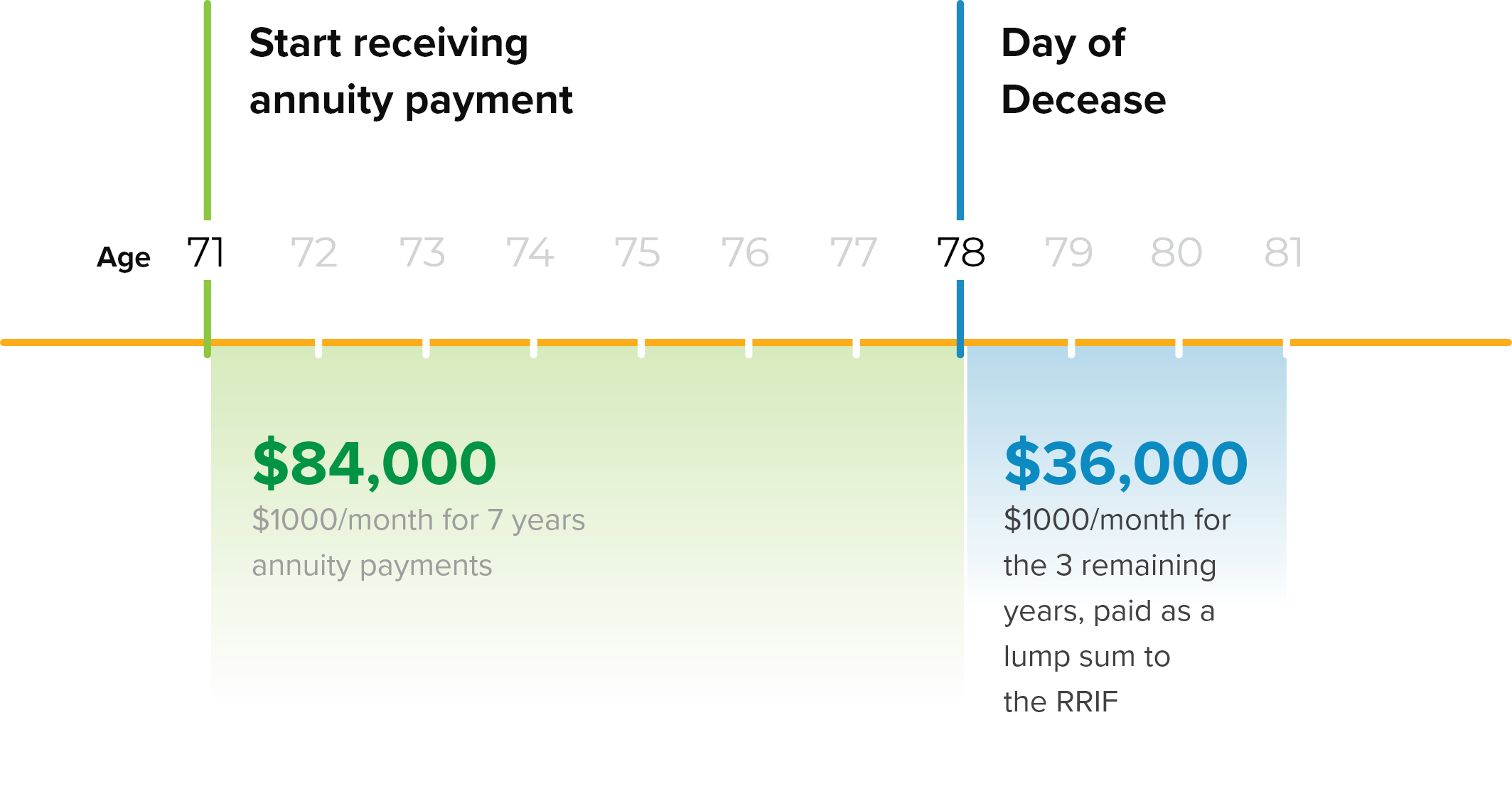

Scenario two

While a member of the Advantages Retirement Plan™, a physician purchases $1,000 of monthly annuity income and elects to retire with the basic form of annuity, which has a 10-year guarantee period. When the physician reaches age 71, they start receiving monthly annuity payments to their registered plan, which have totalled $84,000 when they pass away at age 78.

Because the annuity includes a 10-year guarantee, and there were three years (36 months) remaining on the 10-year guarantee period, the insurer makes a lump-sum payment of $36,000 to the deceased physician’s registered plan (36 months x $1,000 per month).

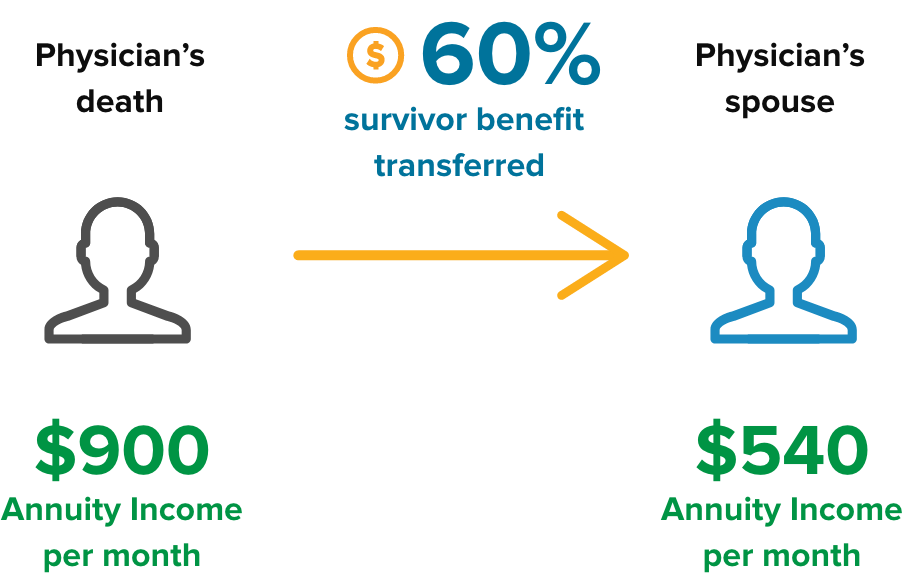

How Guaranteed Lifetime Income Annuity can protect your spouse

At retirement, you can choose a form of annuity that pays a 60 per cent survivor benefit for the lifetime of your spouse (legal or common-law) after your death.

Scenario three

A physician elects the joint and survivor 60 per cent form of annuity. Their $1,000 monthly annuity amount is adjusted for this feature and they collect $900 per month for their lifetime. On the physician’s death, $540 per month is paid into the registered plan for the lifetime of their spouse (who was the spouse at the time their annuity payments commenced). In order to comply with existing tax rules, the physician had transferred their annuity policy into their RRIF and had designated their spouse as the irrevocable successor annuitant of their RRIF.

What happens if you die before receiving any benefit?

If you die before any annuity income payments have started, your registered plan will get a full refund of the total contributions you paid up to your date of death.

Scenario four

A physician joined the Guaranteed Lifetime Income Annuity program early and through their various premium payments, they had paid a total of $125,000. Unfortunately, the physician dies at age 58 before they start receiving their monthly benefits. Upon their death, their registered plan is paid $125,000 in a lump sum.

[1]Subject to the terms of the annuity policy

[2]RRSP or RRIF, as applicable.

Guaranteed lifetime income is provided through a life annuity policy arranged by OMA Insurance Inc., a licensed insurance agency, and underwritten by Blumont Annuity Company, a Canadian life insurance company licensed federally and in all Canadian provinces and territories.

Assuris protection

Assuris protects at least 85 per cent of the monthly income benefit. For policies that have a monthly income benefit of $2,000 or less, policyholders will retain the full amount of their benefit. Learn more about Assuris.